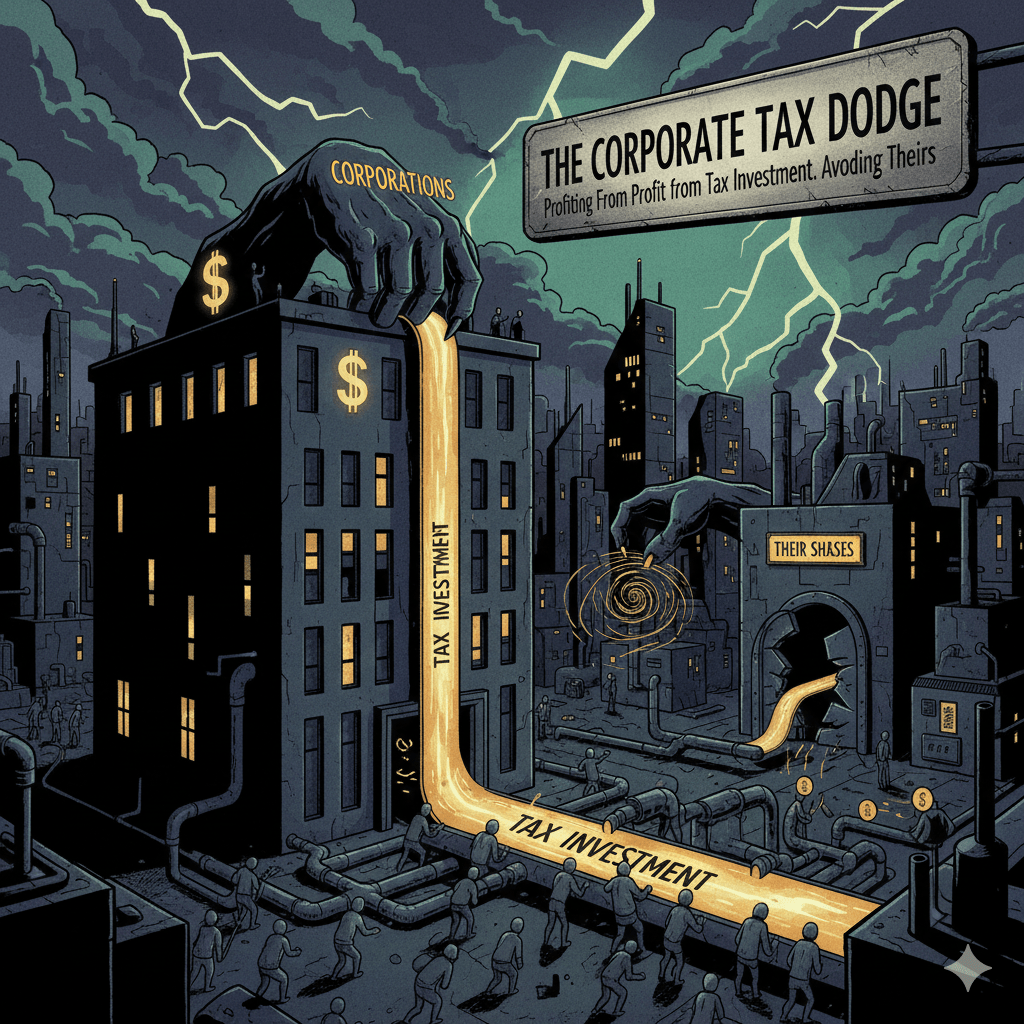

How Corporations Profit from Our Tax Investment While Avoiding Theirs

You’ve heard the story a thousand times: we need to cut corporate taxes to incentivize job creation. Lower the rates, reduce regulations, and watch the jobs flow. The “job creators” need their freedom and their profits, and if we just get out of their way, prosperity will trickle down to the rest of us.

It’s a compelling narrative. It’s also complete bullshit.

Here’s what they don’t mention when they’re selling you this story: these corporations already got incentivized. Massively. For decades. With your tax dollars. We—the bottom 90%—built everything they needed to succeed. The roads their trucks drive on. The internet their platforms run on. The GPS their logistics depend on. The educated workforce they employ. The research that created their products. The courts that enforce their contracts. The police and fire departments that protect their property.

We gave them the greatest economic infrastructure in human history. And we paid for it ourselves.

Now they won’t pay their fair share back. In fact, they’ve rigged the system so thoroughly that many of America’s most profitable corporations—Amazon, Netflix, Chevron—pay zero in federal income taxes. Not a reduced rate. Not a low rate. Zero.

And then—after decades of profiting from infrastructure, research, and education they didn’t pay for—they lobby to cut the very programs they benefited from. Cut infrastructure spending. Cut research funding. Cut education. Privatize everything.

This isn’t capitalism. This is wealth extraction at a scale that would make the robber barons blush. And both parties are in on it because both parties take corporate money.

Let’s follow the money.

1. The Infrastructure They Didn’t Pay For

Every major corporation in America depends on infrastructure they didn’t build and, increasingly, don’t pay for. Here’s what we gave them:

The Interstate Highway System: 48,000 miles of roads built at a cost of over $500 billion (inflation-adjusted). Amazon delivers 1.6 million packages per day using these roads. Walmart operates 6,000 stores connected by these roads. Every trucking company, every logistics operation, every retail chain—they all run on infrastructure we built.

Current road and bridge spending? About $110 billion annually in federal funding, with states and localities adding another $100 billion. Total: over $200 billion per year to maintain the system that makes modern commerce possible. Who pays? We do. Through gas taxes, tolls, and general revenue. Corporations? They pay the same gas taxes as you, but they get infinitely more benefit.

The Internet: Created by DARPA (Defense Advanced Research Projects Agency) with taxpayer funding starting in the 1960s. Total public investment to develop the foundational technology: over $80 billion (inflation-adjusted). Tim Berners-Lee created the World Wide Web at CERN, another publicly funded institution. The National Science Foundation funded the backbone expansion in the 1980s and 1990s.

Who profited? Jeff Bezos built Amazon on it. Worth: $150 billion personal wealth, Amazon market cap $1.5 trillion. Mark Zuckerberg built Facebook on it. Worth: $120 billion personal wealth, Meta market cap $900 billion. Larry Page and Sergey Brin built Google on it. Combined worth: $200 billion, Alphabet market cap $1.7 trillion. Every tech billionaire, every social media platform, every e-commerce site—built on technology we paid to develop.

GPS: Developed by the U.S. Department of Defense, operational in 1995, opened to civilian use at no charge. Development cost: $12 billion. Annual operating cost: $1.5 billion. Every smartphone, every navigation system, every Uber ride, every delivery truck—depends on GPS. Uber, worth $120 billion, wouldn’t exist without it. FedEx and UPS, combined revenue $180 billion annually, depend on it. The entire logistics industry runs on it. They pay nothing for the service.

The U.S. Postal Service: Delivers to every address in America, including rural areas that private companies won’t serve. This universal service obligation creates the foundation for e-commerce. Amazon pays the USPS $3.9 billion annually for deliveries—but this is below the actual cost of service. The Postal Regulatory Commission found that USPS loses money on parcel delivery because rates are set below full cost recovery. Amazon gets subsidized delivery to rural America, undercuts private competitors, then turns around and complains about postal worker wages and benefits.

The Court System: Federal court system budget: $7.7 billion annually. State courts: approximately $50 billion combined. These courts enforce corporate contracts, adjudicate business disputes, protect intellectual property, and handle bankruptcies. Try running a modern corporation without a functioning legal system. It’s impossible. Who pays? We do. Corporations pay filing fees that cover a tiny fraction of the system they depend on.

Police and Fire Protection: Total spending on police: $150 billion annually. Fire protection: $50 billion. These protect corporate property, respond to incidents at corporate facilities, and provide the stable environment that makes commerce possible. Large corporations get the same protection as everyone else but own assets worth billions. Who pays proportionally more? We do, through local property and income taxes.

Airports and Air Traffic Control: The FAA budget is $18 billion annually. This keeps the skies safe and airports functioning. Boeing, worth $150 billion, depends on it. Every airline, every cargo carrier, every business traveler—relies on publicly funded air traffic control. The airlines pay some fees, but nothing close to the full cost of the system.

Ports and Waterways: The Army Corps of Engineers maintains 12,000 miles of inland waterways and 926 coastal, Great Lakes, and inland harbors. Budget: $7 billion annually. These move $5.4 trillion in goods per year. Every import/export business depends on this infrastructure. Who built it? We did.

Total infrastructure investment that corporations depend on but increasingly don’t pay for: easily over $500 billion annually in maintenance and operations alone, with trillions in historical development costs. This is the foundation of their success. And they want to pay less and less toward it.

2. The Research They Didn’t Fund

Here’s how the game works: We fund the research. They take the profits. Then they claim they’re “innovators” who earned every penny.

The National Institutes of Health (NIH): Annual budget: $47 billion (2024). Since 1938, the NIH has funded foundational biomedical research that led to virtually every major pharmaceutical breakthrough. The research is done at universities and public institutions, paid for by taxpayers. Then pharmaceutical companies take the discoveries, patent them, and charge us outrageous prices.

Example: Moderna’s COVID-19 vaccine. The NIH spent $6 billion developing the mRNA technology over decades. When COVID hit, the U.S. government gave Moderna another $1.5 billion to develop and test the vaccine, plus $4.1 billion in pre-purchase commitments. Moderna’s 2021 revenue: $18 billion. Moderna’s profit: $12 billion. How much did taxpayers get back? Zero dollars. Moderna kept 100% of the profits from research we funded.

This isn’t unique to Moderna. The NIH estimates that every dollar invested in health research generates $2.21 in economic output. The pharmaceutical industry generates $550 billion in annual revenue. How much of that came from publicly funded research? A huge percentage. How much do they pay back? Their standard corporate tax rate (which they dodge), and they spend $350 million annually lobbying to keep drug prices high and avoid price negotiations.

DARPA: We already mentioned the internet. But DARPA also developed GPS, stealth technology, voice recognition software (Siri came from DARPA-funded research), the foundations of autonomous vehicles, advanced materials, microprocessors, and countless other innovations. Budget: $3.9 billion annually.

Every tech billionaire built their empire on DARPA research. Larry Page used DARPA-funded algorithms for Google’s search. Elon Musk’s companies use DARPA technology for autonomous driving and aerospace. But when it’s time to pay taxes? Suddenly they’re “self-made” entrepreneurs who owe us nothing.

NASA: Annual budget: $25 billion. NASA spent 60 years developing rocket technology, materials science, satellite technology, and aerospace engineering. Then SpaceX comes along and builds on all of it. Don’t get me wrong—SpaceX has done impressive work. But let’s be clear about the foundation: $25 billion × 60 years = $1.5 trillion in cumulative NASA investment that created the knowledge base SpaceX depends on. Plus, SpaceX has received $15.3 billion in NASA contracts.

Elon Musk’s net worth: $200+ billion. Built on aerospace technology we developed. How much has he paid back in taxes? In 2018, Musk paid zero federal income taxes despite his wealth increasing by billions. In 2021, he paid $11 billion—which sounds like a lot until you realize his wealth increased by $120 billion that year. He paid 9.1% on his wealth increase. Meanwhile, a teacher making $50,000 pays 22% on their income.

Department of Energy (DOE): Budget: $47 billion. The DOE developed foundational battery technology, solar panel efficiency improvements, nuclear energy, and advanced materials. Tesla didn’t invent lithium-ion batteries—DOE-funded research did. Solar companies didn’t figure out how to make efficient panels—DOE-funded research did.

Tesla received $2.4 billion in government subsidies, including a $465 million DOE loan (later repaid), plus billions in regulatory credits that other automakers had to buy. Current market cap: $700 billion. Built on battery technology we funded.

The National Science Foundation: Budget: $9.5 billion annually. Funds basic research across all scientific fields. This research creates the knowledge base that companies commercialize. From computer science to materials science to biotech—NSF-funded research underpins entire industries.

Total annual federal R&D spending: approximately $200 billion. Over decades, we’ve invested trillions in research. Corporations commercialize it, patent it, and profit from it. Then they tell us they can’t afford to pay taxes because they need the money for “R&D.” But corporate R&D spending is mostly applied research and development—taking basic research we funded and turning it into products. They’re not funding the risky fundamental research. We are.

The game is simple: socialize the risk and the investment, privatize the profits. We pay for decades of research that might not pan out. They swoop in, take what works, and become billionaires. Then they lecture us about how hard work and innovation made them successful.

3. The Workforce We Educated

Every corporation needs educated workers. Engineers, accountants, programmers, managers, technicians. Where do they get them? From our publicly funded education system.

Public K-12 Education: Total annual spending: $795 billion. This educates 50 million students, teaching them to read, write, think critically, and follow instructions—all skills corporations depend on. Average per-pupil spending: $15,900 per year for 13 years = $206,700 per student by graduation.

Corporations hire these workers without paying a penny toward their basic education. Then they complain that schools aren’t teaching “job-ready” skills and lobby for tax cuts that defund education further.

State Universities: The University of California system educates 280,000 students annually. State funding: $3.7 billion. The Cal State system educates 460,000 students. State funding: $4.2 billion. Every major state has a public university system heavily subsidized by taxpayers.

A computer science degree from UC Berkeley costs the student about $14,000 per year in tuition. The actual cost to educate that student? Over $40,000 per year. Taxpayers cover the difference—about $26,000 per student per year. For a four-year degree, that’s $104,000 in public subsidy.

That Berkeley CS graduate goes to work for Google at $120,000 per year. Google just got a $104,000 training subsidy from California taxpayers. Google’s effective tax rate? About 15.5%, far below the statutory 21% corporate rate and infinitely below the value they extract from publicly educated workers.

Community Colleges: Educate 10 million students annually, providing vocational training and workforce development. Total spending: approximately $70 billion annually, mostly from state and local taxes. These colleges train dental hygienists, automotive technicians, welders, electricians, medical assistants—workers that corporations desperately need.

Who pays for the training? We do. Who benefits? Corporations hire trained workers they didn’t have to train themselves. Then they lobby to cut education funding because they don’t want to pay the taxes that fund it.

The German Model: In Germany, corporations actually pay to train workers through mandatory apprenticeship programs. Companies must invest in worker development. They can’t just extract the value of publicly educated workers without contributing.

In America? Corporations complain about “skills gaps” while lobbying to defund the education system that trains their workers. Amazon hired 800,000 people in 2020. How much did Amazon pay toward educating those 800,000 workers from kindergarten through high school or college? Zero. Amazon’s 2020 federal tax bill? Also zero.

We paid hundreds of thousands of dollars per worker to educate them. Corporations get the fully trained workforce for free. Then they complain about taxes. It’s extraction, pure and simple.

4. Corporate Tax Rate: From 35% to 21% (And They Still Don’t Pay It)

In December 2017, Republicans passed the Tax Cuts and Jobs Act. The centerpiece: slashing the corporate tax rate from 35% to 21%. The promise: corporations would use their windfall to create jobs, raise wages, and invest in America.

What actually happened? Stock buybacks. Massive, unprecedented stock buybacks.

Total corporate stock buybacks from 2010-2019: $5.3 trillion. In 2018 alone, the year after the tax cuts, buybacks hit $806 billion—a record. In 2019: $728 billion. The trend continued: 2021 saw $882 billion, 2022 saw $923 billion.

What’s a stock buyback? The company uses profits to buy its own shares, reducing the number of shares outstanding. This increases the value of remaining shares. Who benefits? Shareholders and executives with stock options. Who doesn’t benefit? Workers.

Apple’s buybacks (2018-2022): $429 billion. Did they hire hundreds of thousands of new workers? No. Did they raise wages dramatically? No. They made Tim Cook and shareholders richer.

Let’s talk about what corporations actually pay versus what they’re supposed to pay.

The statutory rate is 21%. But here are the effective rates (what companies actually paid) for some of America’s most profitable corporations:

Amazon (2018): $0 in federal income tax on $11.2 billion in profit. Effective rate: 0%. In fact, Amazon received a $129 million tax rebate. They didn’t just pay nothing—they got money back.

Netflix (2018): $0 in federal income tax on $845 million in profit. Effective rate: 0%.

Chevron (2018): Paid -0.5% (negative). Made $4.5 billion in U.S. profit, received a $181 million tax refund.

General Motors (2018): $0 in federal income tax on $4.3 billion in profit.

And it’s not just 2018. From 2018 to 2020, 55 of America’s largest corporations paid zero federal income taxes despite being profitable. Combined profits: $40.5 billion. Total taxes paid: $0.

Even the tech giants who pay something pay far below the statutory rate:

Apple (2018-2020 average): Effective rate around 14-17%. Saved billions by keeping $252 billion offshore.

Google/Alphabet (2018-2020 average): Effective rate around 14-16%.

Microsoft (2018-2020 average): Effective rate around 16.8%.

Facebook/Meta (2020): Effective rate 11.8%.

These are some of the most profitable companies in human history. They depend entirely on infrastructure, research, and educated workers paid for by taxpayers. And they pay effective rates of 0-17%, far below the already-reduced 21% statutory rate.

Meanwhile, if you’re a W-2 employee making $50,000, you pay 22% federal income tax plus 7.65% FICA (Social Security and Medicare). Effective rate: 29.65%. You pay more than Amazon, Netflix, Google, or Apple.

The corporate tax cut cost $1.5 trillion over ten years. We were promised jobs and investment. We got stock buybacks and billionaires getting richer. And corporations still found ways to pay even less than the reduced rate.

5. How They Dodge Taxes

How do profitable corporations pay zero taxes? Through an elaborate system of legal loopholes, accounting tricks, and lobbying. Here’s the playbook:

Offshore Profit Shifting: Move profits to low-tax countries even though the actual business happens in America. This is the big one.

Example: Apple’s “Double Irish Dutch Sandwich” (used until 2020). Here’s how it worked: Apple creates a subsidiary in Ireland (low tax rate) that “owns” Apple’s intellectual property. Every iPhone sold in the U.S. triggers a payment from Apple Inc. to Apple Ireland for the “rights” to use Apple’s own technology. This payment is a tax-deductible expense in the U.S. (reducing U.S. profits) but is counted as income in Ireland (where the tax rate was 12.5%, later increased). But wait—the money doesn’t even stay in Ireland. It goes through a Dutch subsidiary (no withholding taxes on transfers) and ends up in a second Irish company that’s technically “managed” in a tax haven like Bermuda (0% tax rate).

Result: Profits made in America, by American consumers buying American-designed products, end up taxed at close to 0%. Before the 2017 tax law changes, Apple had $252 billion in profits held offshore. Other tech companies: Google ($67 billion offshore), Microsoft ($142 billion offshore), Cisco ($64 billion offshore).

The 2017 tax law was supposed to fix this with a one-time repatriation tax of 15.5% on cash and 8% on non-cash assets. Sound good? It’s still a massive discount. Apple paid about $38 billion on $252 billion (effective rate: 15%), saving tens of billions compared to the previous 35% rate. And the loopholes for ongoing profit shifting? Still largely in place, just rearranged.

Transfer Pricing: Sell goods or services to your own subsidiaries at artificially low or high prices to shift profits to low-tax jurisdictions.

Example: A pharmaceutical company manufactures a drug in Puerto Rico (where they get tax breaks). They “sell” it to their own Irish subsidiary for $10 per pill (artificially low). The Irish subsidiary then “sells” it to the U.S. subsidiary for $100 per pill (artificially high). The U.S. subsidiary sells it to consumers for $110. U.S. profit: $10 per pill. Irish profit: $90 per pill (taxed at 12.5%). The drug was always destined for U.S. patients, but 90% of the profit disappears to Ireland.

Corporate Inversions: Merge with a smaller foreign company and reincorporate in their lower-tax country while keeping operations in the U.S.

Example: Burger King bought Canadian coffee chain Tim Hortons in 2014 and reincorporated in Canada (lower tax rate). Burger King’s operations in the U.S. didn’t change—same stores, same workers, same infrastructure—but now their profits are taxed at Canadian rates. The 2017 tax law tried to discourage this, but companies still do it through complex structures.

Intellectual Property Licensing: License your own patents, trademarks, and copyrights to your own offshore subsidiaries. Then pay yourself royalties that are tax-deductible in the U.S. but taxed at low rates offshore.

Example: Microsoft licenses Windows to its own Puerto Rican subsidiary. Every copy of Windows sold in the U.S. triggers a royalty payment from Microsoft U.S. to Microsoft Puerto Rico. The payment reduces U.S. profit (deductible expense) and shows up as profit in Puerto Rico (taxed at low rates). It’s the same company selling to itself, but profits magically move to low-tax jurisdictions.

Accelerated Depreciation: Deduct the full cost of equipment, buildings, and other capital investments far faster than they actually wear out.

Example: Amazon buys $1 billion in warehouse equipment. Under accelerated depreciation rules, they can deduct most of that $1 billion in year one, even though the equipment will last 20 years. This creates massive tax deductions upfront that offset current profits, resulting in zero tax bills despite huge actual profits. The equipment is still generating income for Amazon for years, but the tax deduction was front-loaded.

Stock Option Deductions: When executives exercise stock options, companies get to deduct the difference between the option price and the market price as a compensation expense.

Example: A CEO gets 1 million stock options at $10 per share. Five years later, the stock is at $100. CEO exercises options, making $90 million. The company gets to deduct $90 million from their taxable income, even though they never actually paid out $90 million in cash. It’s a paper expense that creates a real tax deduction.

This is how Amazon paid zero taxes in 2018 despite $11 billion in profit. Stock-based compensation deductions: $1.1 billion. Accelerated depreciation and other deductions: billions more. Suddenly $11 billion in profit becomes $0 in taxable income.

Tax Loss Carryforwards: If a company loses money one year, they can carry that loss forward to offset future profits.

Example: Amazon lost money for years while building its empire. Those losses accumulated. Then, when Amazon became wildly profitable, they used old losses to offset new profits. This is somewhat reasonable—you don’t want to tax companies on temporary profitability after years of losses. But Amazon turned it into an art form, using losses from the 1990s to avoid taxes in the 2010s when they were one of the most profitable companies on Earth.

All of these strategies are legal. That’s the problem. Corporations spend billions lobbying to create and preserve these loopholes. Then they hire armies of accountants and lawyers to exploit them. The result: the most profitable corporations in American history pay effective tax rates lower than a middle-class worker.

6. Small Business vs. Big Business: The Tax Code Already Screws the Little Guy

Politicians love to talk about helping small businesses with tax cuts. Here’s what they don’t tell you: the current tax code already massively favors big corporations over actual small businesses.

I run a small corporation. I pay close to the 21% statutory rate. Why? Because I can’t afford the army of tax lawyers and accountants that Amazon employs. I can’t set up subsidiaries in Ireland and the Cayman Islands. I can’t engage in transfer pricing schemes. I can’t do corporate inversions.

The mom-and-pop restaurant, the local contractor, the small manufacturer—they all pay close to the full statutory rate. They don’t have offshore tax havens. They can’t deduct stock options because they don’t have stock options. They actually pay what they owe.

Meanwhile, Amazon, Netflix, and Chevron pay 0%. Apple and Google pay 15%. These are trillion-dollar companies with vast resources, and they pay a lower rate than the corner bakery.

The effective corporate tax rate by company size tells the story:

Companies with revenue under $25 million: Average effective rate around 18-20%.

Companies with revenue $25-100 million: Average effective rate around 16-18%.

Companies with revenue over $1 billion: Average effective rate around 11-14%.

The bigger you are, the less you pay. This is completely backward. Economies of scale should mean big companies pay more efficiently, not that they get away with paying nothing.

Small businesses also can’t write off expenses the way big corporations can. I can’t deduct my home office the way Amazon deducts its warehouses. I can’t use accelerated depreciation to the same extent. I can’t shift profits offshore because my business is here, serving local customers.

When politicians talk about “cutting taxes on small business,” they usually just cut rates across the board—which helps Amazon far more than it helps the local hardware store. A 1% rate reduction on Amazon’s $30 billion in U.S. profits = $300 million saved. A 1% rate reduction on a small business’s $200,000 profit = $2,000 saved. Amazon gets 150,000 times more benefit.

If we actually wanted to help small businesses, we’d close the loopholes that only big corporations can exploit, increase deductions for actual small businesses, and stop pretending that “pro-business” tax cuts help anyone except megacorporations.

7. The Healthcare and Retirement Subsidy: We Cover Their Labor Costs

Here’s another way corporations extract wealth: they pay workers so little, or structure employment to avoid benefits so thoroughly, that taxpayers end up subsidizing their labor costs through public assistance.

Walmart: America’s largest private employer with 1.6 million U.S. workers. Walmart workers are among the largest groups receiving Medicaid and food stamps. Total cost to taxpayers: estimated at $6.2 billion annually just for Walmart employees.

Think about that. Walmart, owned by the Walton family (combined wealth: $250 billion), pays workers so little that we—taxpayers—cover their healthcare and food through Medicaid and SNAP (food stamps). Walmart’s 2023 profit: $11.7 billion. They could afford to pay workers more and provide healthcare. They choose not to. We pick up the bill.

Amazon: Median employee pay is $32,855 per year. At that income level in most states, workers qualify for Medicaid. An estimated 4,000 Amazon employees in Arizona are on Medicaid. Thousands more in other states. How much is Amazon saving by not providing adequate healthcare? Billions.

McDonald’s: Literally had a hotline advising workers how to sign up for public assistance. The leaked recording told workers to apply for food stamps and Medicaid because McDonald’s wages weren’t enough to live on. McDonald’s profit margin: consistently 20-25%. They’re not struggling. They’re extracting.

The part-time and contractor dodge: Companies increasingly classify workers as part-time or contractors to avoid providing benefits. Work 39 hours a week? Not full-time, no benefits. Work as a contractor? Not an employee, no benefits.

FedEx Ground: For years, classified drivers as independent contractors, avoiding billions in employment taxes, workers’ comp, and benefits. In 2019, FedEx settled lawsuits for $240 million. But they’d already saved far more than that by misclassifying workers for decades.

Uber and Lyft: Classify all drivers as contractors. No healthcare, no retirement, no workers’ comp, no unemployment insurance. California voters passed Prop 22 in 2020 (after Uber and Lyft spent $200 million) to keep drivers classified as contractors. The companies save about $500 million annually in California alone by avoiding employment costs.

Retirement? Forget it. Only 67% of private-sector workers have access to employer-sponsored retirement plans. Among low-wage workers, it’s under 50%. Corporations that cut pensions and eliminated defined-benefit plans now don’t even offer 401(k)s to many workers.

Result: Workers retire with inadequate savings, depend on Social Security (which corporations lobby to cut), and often need Medicaid in retirement. Once again, taxpayers cover the costs that corporations should have covered through adequate wages and benefits.

Total annual cost to taxpayers for subsidizing low-wage corporate workers: estimated at over $150 billion annually in Medicaid, food stamps, housing assistance, and other programs.

This isn’t capitalism. Capitalism means you pay your workers enough to live. This is wealth extraction: privatize the profits, socialize the labor costs.

8. Then They Lobby to Cut What We Funded

After decades of profiting from infrastructure, research, and education they didn’t pay for, corporations now lobby aggressively to cut the very programs that enabled their success.

Infrastructure: The Chamber of Commerce and Business Roundtable lobby against infrastructure spending unless it comes with massive tax breaks for corporations. The 2021 infrastructure bill passed only after being scaled down from $2.3 trillion to $1.2 trillion, and even then, corporate interests fought parts of it.

Corporate lobbyists argue: “Infrastructure spending should be paid for by user fees and tolls, not corporate taxes.” Translation: they want you to pay directly every time you drive somewhere, while they ship millions of tons of goods on the same roads for free.

Research Funding: Pharmaceutical companies lobby to keep NIH funding flat while protecting their ability to patent NIH-funded discoveries. The PhRMA (Pharmaceutical Research and Manufacturers of America) spent $24.8 million on lobbying in 2022. Their priority? Blocking drug price negotiations while benefiting from billions in NIH research.

Tech companies lobby against increases to NSF and DARPA funding unless it comes with attached corporate subsidies. They want the research we fund, but they don’t want to pay for it.

Education: Corporate interests consistently lobby to cut education spending and teacher pay. The reason? Lower education spending means lower taxes on corporations. They hire educated workers trained by public schools and universities, but they fight every tax increase that would adequately fund those institutions.

The Koch brothers network alone spent hundreds of millions lobbying against public education funding while simultaneously lobbying for corporate tax cuts. Meanwhile, Koch Industries recruits chemists and engineers trained at public universities.

Privatization Push: After benefiting from public infrastructure, research, and education, corporate lobbyists now push to privatize everything. Privatize roads (turn them into toll roads owned by corporations). Privatize research (so corporations can patent publicly funded discoveries). Privatize education (charter schools and vouchers that funnel public money to private companies).

The pattern is clear: extract value from public investments, then dismantle those public investments so only corporations can provide services—at a profit.

Total corporate lobbying spending (2022): $3.8 billion. The top spenders:

U.S. Chamber of Commerce: $67 million. Lobbies for lower corporate taxes, fewer regulations, cuts to social programs.

Business Roundtable: $29 million. Represents CEOs of major corporations, lobbies for tax cuts and deregulation.

National Association of Manufacturers: $13 million.

Amazon: $21.4 million in lobbying (2022). What do they lobby for? Lower taxes, fewer worker protections, weaker unions.

Both parties take this money. Democrats take corporate donations. Republicans take corporate donations. The result? Both parties support policies that benefit corporations at the expense of workers and taxpayers.

They got rich using infrastructure we built, research we funded, and workers we educated. Now they lobby to cut all of it so they can pay even less in taxes. It’s extraction all the way down.

9. International Comparisons: Other Countries Make Corporations Pay

The narrative in America is that if we raise corporate taxes, companies will flee overseas. Let’s look at what other developed countries actually do.

Corporate tax rates in OECD countries:

United States: 21% statutory, but effective rates often 0-15% for large corporations.

Germany: 30% combined federal and local rate. Effective rate paid by large corporations: approximately 22-25%. They actually enforce it.

France: 25% statutory rate (reduced from 33% in 2018). Effective rates for large corporations: 20-23%. Much higher than U.S. effective rates.

Japan: 30% combined national and local rate. Effective rates: 25-28%.

United Kingdom: 25% rate (increased in 2023). Fewer loopholes than the U.S.

Nordic countries: Denmark 22%, Finland 20%, Norway 22%, Sweden 20.6%. Despite these rates, these countries maintain highly competitive economies, better infrastructure than the U.S., better education systems, and stronger worker protections.

The key difference: Other countries actually collect the taxes they’re owed. They have fewer loopholes. They enforce anti-avoidance rules. They don’t let corporations shift profits to tax havens as easily.

OECD Minimum Tax Agreement: In 2021, 137 countries agreed to a global minimum corporate tax of 15%. The goal: stop the race to the bottom where countries compete to offer the lowest tax rates. This would prevent profit shifting to tax havens.

The U.S. signed on but hasn’t fully implemented it. Why? Corporate lobbying. The same corporations that benefit from U.S. infrastructure don’t want to pay even a 15% minimum.

Have German companies fled to tax havens? No. Germany has a strong manufacturing base, excellent infrastructure, and corporations that actually pay taxes. GDP per capita: $52,824 (2023). Quality of life: consistently ranked higher than the U.S.

Have French companies collapsed under high taxes? No. France has major global corporations (LVMH, TotalEnergies, Airbus) and maintains excellent public services. GDP per capita: $47,359 (2023).

Have Nordic countries lost their competitive edge? No. Denmark, Finland, Norway, and Sweden consistently rank among the most competitive, innovative, and prosperous countries on Earth. They have universal healthcare, free university, strong unions, excellent infrastructure—and they make corporations pay for it.

The idea that corporations will flee if we make them pay fair taxes is propaganda. Corporations stay where there’s infrastructure, educated workers, political stability, rule of law, and consumer markets—all things we provide. They just don’t want to pay for any of it.

10. Solutions: Employment-Focused Tax Reform

Here’s the problem with most proposed tax reforms: they’re either too complex (easy to game), too simple (unfair), or they focus on the wrong thing (revenue instead of behavior).

What we need is a system that:

1. Incentivizes productive behavior (creating jobs, paying good wages, providing benefits)

2. Penalizes extractive behavior (layoffs while profitable, stock buybacks, contractor abuse)

3. Is simple enough that corporations can’t game it

4. Is automatic and impossible to dodge

Here’s a comprehensive employment-focused corporate tax reform:

A. Base Rate on Book Income (What You Tell Shareholders)

Currently, corporations report one set of profits to shareholders (to make the stock look good) and a different, much lower set of profits to the IRS (to pay less tax). This is the fundamental game.

Solution: Corporate tax rate of 28% on book income—the profit reported to shareholders in SEC filings.

If you tell your investors you made $10 billion in profit, you pay the IRS 28% on that $10 billion. No separate “tax accounting.” No games. You can’t simultaneously tell shareholders you’re wildly profitable and tell the IRS you made nothing.

This immediately closes most loopholes. Amazon can’t tell shareholders it made $30 billion while telling the IRS it owes nothing. Pick one: either you’re not profitable (tell your shareholders), or you’re profitable (pay taxes on it).

B. Employment Credits (Lower Rates for Job Creation)

Want a lower tax rate? Create good jobs with good benefits.

Employment Tax Credit: For every full-time U.S. employee earning above $50,000/year with health insurance and retirement benefits, reduce your tax rate by 0.02%.

Example: You employ 1,000 full-time workers at $60,000 each with benefits. You get a 20% reduction in your tax rate (1,000 × 0.02%). Your rate drops from 28% to 22.4%.

This directly rewards companies that create good middle-class jobs. You want lower taxes? Hire more people and treat them well.

C. Layoff Penalty Tax

One of the most obscene practices in modern corporate America: report record profits to shareholders, then lay off thousands of workers in the same year to boost stock prices.

Solution: If you report a profit and reduce your workforce by more than 5% in the same year, pay a 50% surtax on profits.

Example: You report $1 billion in profit and lay off 10% of your workforce. Your effective tax rate goes from 28% to 42% (28% base + 14% surtax). If you want to avoid the penalty, don’t report huge profits while throwing people out of work.

This immediately stops the “record profits + mass layoffs” extraction model. Companies can still restructure when necessary, but if you’re profitable, you can’t simultaneously be laying people off.

D. Contractor Misclassification Surtax

Corporations increasingly use contractors and temps to avoid providing benefits. Let’s make that expensive.

Solution: If more than 30% of your workforce consists of contractors, temps, or part-time workers, pay a 10% surtax on profits.

Example: You have 5,000 employees and 3,000 contractors (37.5% of workforce). You pay an additional 10% on top of your base rate. Rate goes from 28% to 38%.

This eliminates the financial advantage of the contractor model. Either hire people as actual employees with benefits, or pay the surtax that funds the public benefits (Medicaid, etc.) your contractors will need.

E. Small Business Gets Actual Benefits

The current system screws small businesses. Let’s fix that.

For businesses with revenue under $25 million:

• Full deductibility for equipment, home office, business expenses

• Health insurance premiums fully deductible

• Retirement contributions fully deductible

• Simplified accounting—no complex corporate structures needed

• Lower base rate: 18% instead of 28%

This makes the system fair. Small businesses that actually can’t afford expensive tax strategies get real breaks. Amazon gets no breaks unless they create jobs.

F. Stock Buyback Tax

Congress passed a 1% stock buyback tax in 2022. It’s a start, but it’s nowhere near enough.

Solution: Increase stock buyback tax to 10%.

If you want to buy back $10 billion in stock, you pay $1 billion in tax. This makes buybacks far less attractive and encourages companies to invest profits in workers, equipment, and R&D instead of stock price manipulation.

G. Profit Distribution Requirement

For corporations with annual profits exceeding $1 billion:

At least 30% of profits must be spent on wages and benefits, capital investment, or R&D. No more than 70% can go to buybacks, dividends, and executive compensation combined.

This ensures that hugely profitable companies actually invest in their workforce and growth instead of just enriching shareholders and executives.

H. CEO/Worker Pay Ratio Surtax

In 1965, the average CEO-to-worker pay ratio was 21:1. In 2023, it’s 344:1. This isn’t productivity—it’s extraction.

Solution: Graduated surtax based on CEO-to-median-worker pay ratio:

• CEO makes 100-199x median worker: 0% surtax (ratio is reasonable)

• CEO makes 200-299x median worker: 5% surtax

• CEO makes 300-399x median worker: 10% surtax

• CEO makes 400-499x median worker: 15% surtax

• CEO makes 500x+ median worker: 20% surtax

This creates a direct incentive to either pay CEOs less or pay workers more. If your CEO makes 500x what your median worker makes, your effective corporate tax rate goes up by 20%.

I. Mandatory Healthcare and Retirement Contributions

Corporations with more than 50 employees must contribute:

• 6% of each employee’s salary to a universal healthcare fund

• 6% of each employee’s salary to their retirement account (401k, IRA, or equivalent)

This applies to all workers at the company—full-time, part-time, and contractors. If you use contractors, you still pay their healthcare and retirement.

This eliminates the contractor dodge. Walmart and Amazon can’t push workers onto Medicaid. They contribute to their workers’ healthcare and retirement, period.

J. Public Beneficial Ownership Registry

Every corporation operating in the U.S. must publicly disclose:

• All owners with more than 5% stake

• All subsidiaries and parent companies

• Country of incorporation and all countries where profits are held

• Effective tax rate paid in each jurisdiction

No more hiding behind Delaware LLCs and offshore structures. Want to do business in America? Operate transparently.

Result of These Reforms:

Company A: Employs 10,000 workers at good wages with full benefits, reinvests profits in R&D and equipment, CEO makes 120x median worker.

Effective rate: 28% base – 6% employment credit = 22%

Company B: Minimal employees, 50% contractors, reports $1 billion profit while laying off 8% of workforce, spends 80% of profits on buybacks, CEO makes 450x median worker.

Effective rate: 28% base + 10% contractor surtax + 14% layoff penalty + 15% CEO ratio surtax = 67%

This system incentivizes productive capitalism (jobs, investment, fair pay) and penalizes extraction (layoffs, buybacks, contractor abuse, executive excess). It’s automatic, tied to measurable outcomes, and impossible to dodge through accounting tricks.

Conclusion: They Didn’t Build It—We Did

Let’s be absolutely clear about what happened here:

We built the interstate highway system. We funded DARPA research that created the internet. We developed GPS through the military. We educated the workforce through public schools and universities. We funded the NIH research that created pharmaceutical breakthroughs. We funded NASA research that enabled commercial spaceflight. We funded DOE research that developed battery and solar technology. We maintain the courts, police, and fire departments that protect corporate property. We deliver mail to rural areas at a loss so e-commerce can exist.

Corporations built their empires on this foundation. Then they rigged the tax code so they pay almost nothing back. Amazon, Netflix, Chevron—zero federal taxes despite billions in profit. Apple, Google, Microsoft—effective rates of 14-17% instead of the 21% statutory rate. All while a worker making $50,000 pays 22% plus payroll taxes.

Then they push their workers onto Medicaid and food stamps, making taxpayers subsidize their labor costs. Walmart alone costs us $6.2 billion annually in public assistance for workers they don’t pay enough. Total cost across all corporations: over $150 billion annually.

Then they lobby—$3.8 billion annually—to cut the infrastructure spending, research funding, and education programs they benefited from. They want to privatize everything so only they can provide services—at a profit.

Both parties take their money. Both parties support policies that benefit corporations at our expense. The corporate tax rate dropped from 35% to 21%, costing $1.5 trillion. Stock buybacks hit $5.3 trillion while wages stagnated. CEO pay went from 21x median worker to 344x. Meanwhile, infrastructure crumbles, public education is underfunded, and we’re told we can’t afford universal healthcare.

This isn’t capitalism. Capitalism worked in the 1950s-1970s when corporate rates were 52%, CEOs made 21x workers (not 344x), and unions represented 35% of workers (not 10%). That system built the American middle class.

What we have now is wealth extraction. Corporations extract value from infrastructure we built, research we funded, and workers we educated—then avoid paying their share through offshore tax havens, transfer pricing, accelerated depreciation, and armies of lawyers. Small businesses pay close to the full rate. Trillion-dollar corporations pay nothing.

The solution isn’t more of the same. We need employment-focused tax reform that:

• Bases taxes on book income (what companies tell shareholders)

• Rewards job creation with lower rates

• Penalizes extraction (layoffs, buybacks, contractor abuse, CEO excess)

• Actually helps small businesses instead of pretending rate cuts help everyone equally

• Makes corporations contribute to worker healthcare and retirement

• Requires transparency in ownership and tax payments

Companies that employ people well, pay decent wages, and provide benefits should get lower rates—around 20%. Companies that lay people off while profitable, abuse contractors, buy back stock instead of investing in workers, and pay CEOs 500x the median worker should pay 45%+.

This isn’t radical. What’s radical is the current system where corporations profit from investments they didn’t make, avoid taxes through legal loopholes, push costs onto taxpayers, then lobby to cut the programs that enabled their success.

Other countries make corporations pay their fair share and maintain better infrastructure, education, and quality of life than we do. Germany, France, Japan, Nordic countries—they all have higher effective corporate tax rates and better outcomes for their citizens.

The bottom 90% of us have a unified interest here. Whether you vote Democrat or Republican, whether you live in a city or rural area, whether you’re young or old—you pay taxes while Amazon pays zero. You subsidize Walmart workers’ healthcare while the Walton family is worth $250 billion. Your kids go to underfunded schools while Apple holds $252 billion offshore. Your roads are full of potholes while corporations that use them most pay the least to maintain them.

This is a wealth extraction system, not an economic system. We built the infrastructure. We funded the research. We educated the workforce. They got rich using it. Now they need to pay their fair share.

And the tax system should reward productive capitalism—creating jobs, paying good wages, investing in workers—while penalizing extraction. That’s not socialism. That’s fixing capitalism so it works for the people who actually produce value instead of just the people who extract it.

They didn’t build their success. We did. Time to send them the bill.

Leave a comment