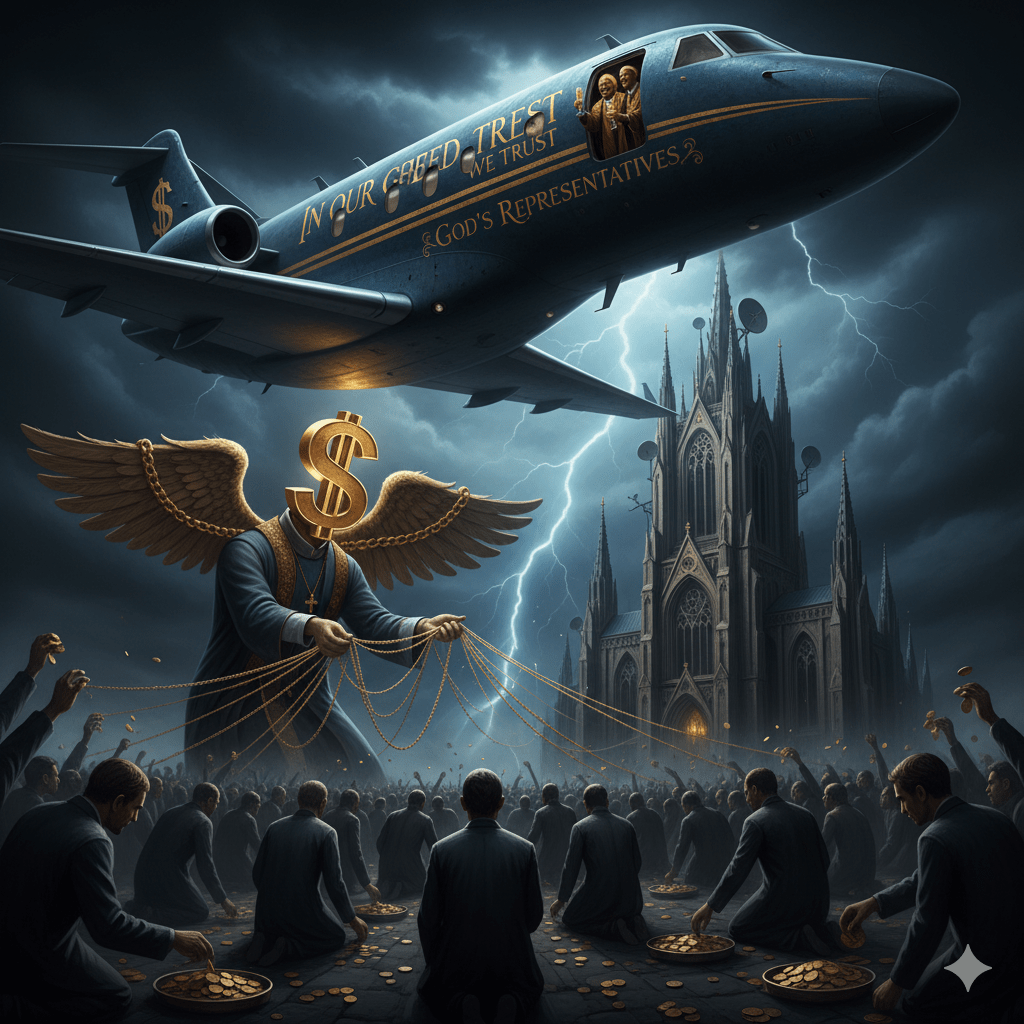

When God’s Representatives Want Private Jets

In Part 15, we established that religion can’t be questioned without risking damnation. It’s God’s will. Divine authority. Absolute truth.

Now let’s talk about what happens when you combine unquestionable authority with zero financial accountability: the biggest, most profitable con in American history.

Kenneth Copeland has a net worth estimated at $760 million. He owns multiple private jets. When asked why he needs a private jet, he said commercial airlines are “a long tube with a bunch of demons.” His ministry, Kenneth Copeland Ministries, is tax-exempt.

Joel Osteen, pastor of Lakewood Church in Houston, has a net worth around $100 million. He lives in a $10.5 million mansion. His church, housed in the former Compaq Center arena, seats 16,800 people. Lakewood Church generates approximately $90 million annually. Tax-exempt.

Creflo Dollar—yes, that’s his real name—requested $65 million from his congregation to buy a Gulfstream G650 private jet. He said God told him he needed it. His net worth is estimated at $27 million. Tax-exempt.

T.D. Jakes has a net worth around $20 million. Benny Hinn: $60 million. Joyce Meyer: $8 million. Pat Robertson (before his death): $100 million. All running tax-exempt religious organizations.

Here’s Jesus on wealth: “It is easier for a camel to go through the eye of a needle than for a rich man to enter the kingdom of God.” Also Jesus: “Sell your possessions and give to the poor.” Also Jesus: “You cannot serve both God and money.”

But American Christianity found a loophole: the prosperity gospel. God WANTS you to be rich. Your wealth proves God’s favor. Send money to these ministries and God will reward you with even more money. It’s not greed—it’s faith.

This is wealth extraction disguised as spirituality. And it’s extraordinarily profitable because it exploits people’s deepest beliefs and fears while enjoying complete tax exemption and minimal oversight.

The Megachurch Business Model: Salvation for Sale

A megachurch is defined as a Protestant congregation with at least 2,000 members. In 2023, there were approximately 1,750 megachurches in the United States, up from just 50 in 1970.

These aren’t just churches. They’re entertainment complexes, media empires, and financial powerhouses. And they’re all tax-exempt.

The Numbers

Let’s look at some specific megachurches and their finances:

Lakewood Church (Joel Osteen):

- Annual revenue: ~$90 million

- Weekly attendance: ~43,000

- Osteen’s personal net worth: $100 million

- Book deal income (separate from church, but promoted through church platform): $55 million advance for one book

- During Hurricane Harvey (2017), Osteen initially refused to open the church as a shelter until public outcry forced him to

Life.Church (Craig Groeschel):

- Annual revenue: ~$110 million

- Multi-site church with 40+ locations

- Created YouVersion Bible app (100+ million downloads) for free, but uses it to drive traffic to church

- Groeschel’s net worth: estimated $10 million+

Elevation Church (Steven Furtick):

- Annual revenue: ~$38 million

- Furtick lives in a 16,000 square foot mansion valued at $1.7 million (tax records)

- Church refused to disclose Furtick’s salary when questioned

- Estimated net worth: $55 million

Hillsong Church:

- Global annual revenue: ~$100 million

- Founder Brian Houston’s salary: $333,000 annually (disclosed), plus housing allowances and perks

- Houston resigned in 2022 amid scandals including covering up his father’s sexual abuse of children

- Hillsong music empire generates separate revenue through albums and licensing

These are just a few examples. Across all megachurches, we’re talking about billions in annual revenue, all of it tax-exempt.

How the Model Works

Modern megachurches operate more like corporations than traditional churches:

1. Entertainment Value:

Professional bands, light shows, high-quality video production, motivational speaking rather than traditional sermons. The experience is designed to compete with entertainment options, not just other churches.

2. Minimal Theology, Maximum Motivation:

Messages focus on personal success, positive thinking, and God’s blessings rather than sacrifice, sin, or judgment. This is more appealing to casual attendees and doesn’t challenge comfortable lifestyles.

3. Multiple Revenue Streams:

- Tithes and offerings (typically 10% of member income is encouraged)

- Book sales (often mandatory reading for church programs)

- Conference tickets ($50-500 per ticket, thousands of attendees)

- Merchandise (branded clothing, accessories, decor)

- Media sales (DVDs, streaming subscriptions, music)

- Church-branded coffee shops, bookstores, and gift shops

- Private schools and daycare (tuition-based, but affiliated with tax-exempt church)

4. Volunteer Labor:

Most megachurch labor is volunteer. Members are encouraged to “serve” by working for free as greeters, parking attendants, tech crew, musicians, childcare workers, and administrative staff. This dramatically reduces operating costs.

5. Scalability:

Video technology allows one pastor to preach to multiple campuses simultaneously. The marginal cost of adding another location is minimal once the production infrastructure exists.

6. Tax-Free Status:

Unlike every other business, churches pay zero federal income tax, zero state income tax, zero property tax, and donors can deduct contributions. This gives them an enormous competitive advantage.

The result: a business model that generates massive revenue with minimal costs, zero taxation, limited accountability, and protected by the sacred nature of religion.

The Prosperity Gospel: Theological Justification for Greed

The prosperity gospel is the theological innovation that makes this entire system work. It flips Christianity’s historical emphasis on poverty and suffering into a religion that celebrates wealth as divine blessing.

The Core Teaching

The prosperity gospel teaches:

- God wants you to be wealthy and healthy

- Financial success is proof of God’s favor and your faith

- Poverty is a sign of insufficient faith or sin

- “Seed faith” – give money to ministries and God will multiply it back to you

- Claiming wealth through positive confession – speak your desires and God will provide

- The more you give to the church, the more God will bless you financially

This is essentially a religious pyramid scheme. Give money up the pyramid (to the ministry), and God will send money down to you. Except the people at the top get rich while the people at the bottom stay poor and wonder why their faith isn’t strong enough.

The Biblical Contradiction

The prosperity gospel requires ignoring or reinterpreting vast swaths of scripture:

Jesus on wealth:

- “It is easier for a camel to go through the eye of a needle than for a rich man to enter the kingdom of God” (Matthew 19:24)

- “Sell your possessions and give to the poor” (Luke 12:33)

- “You cannot serve both God and money” (Matthew 6:24)

- “Blessed are the poor in spirit” (Matthew 5:3)

- “Woe to you who are rich, for you have already received your comfort” (Luke 6:24)

James on wealth:

- “Now listen, you rich people, weep and wail because of the misery that is coming on you. Your wealth has rotted… You have lived on earth in luxury and self-indulgence” (James 5:1-5)

Paul on wealth:

- “For the love of money is a root of all kinds of evil” (1 Timothy 6:10)

- “I have learned to be content whatever the circumstances… in plenty or in want” (Philippians 4:11-12)

The Bible is absolutely clear: wealth is spiritually dangerous, poverty isn’t a curse, and material prosperity has nothing to do with God’s favor. The prosperity gospel inverts all of this.

But the inversion is incredibly useful. It justifies the pastor’s wealth (God is blessing them for their faith). It justifies inequality (the rich deserve it, the poor lack faith). It generates revenue (give money to receive money). And it prevents criticism (questioning the pastor’s wealth means questioning God’s blessings).

The Exploitation

The prosperity gospel particularly exploits poor and struggling people—the exact people Jesus said deserved special care.

Studies show prosperity gospel messages appeal most to people facing financial hardship. They’re desperate for hope that things will get better. So they give money they can’t afford to give, believing God will multiply it back.

When the money doesn’t come back, they’re told their faith wasn’t strong enough. So they give more. Or they’re told they need to “sow a bigger seed.” Or they’re told Satan is blocking their blessing.

The system is designed so that failure is always the believer’s fault, never the teaching’s fault. Can’t lose if you rig the game that way.

Examples of this exploitation:

- Elderly people on fixed incomes sending their Social Security checks to televangelists

- Sick people refusing medical treatment because they were told faith healing was the answer

- Families going into debt to give “seed faith” offerings

- People selling possessions to send money to ministries

- Students using student loan money to pay tithes

Meanwhile, the pastors get richer. The pattern is always the same: poverty flows up, wealth accumulates at the top, and religion provides the unquestionable justification.

The $83.5 Billion Tax Exemption: Subsidizing Religion

Here’s the most absurd part: American taxpayers subsidize all of this.

Religious organizations in the United States enjoy automatic tax exemption under Section 501(c)(3) of the tax code. They don’t pay federal income tax, state income tax, property tax, or sales tax. And donations to churches are tax-deductible for the donor.

The cost to taxpayers: approximately $83.5 billion annually in lost tax revenue, according to a 2012 study by University of Tampa professor Ryan Cragun.

That breaks down to:

- $26.2 billion in federal income tax exemption

- $35.3 billion in tax-deductible contributions

- $16.5 billion in property tax exemption

- $5.5 billion in other tax exemptions

To put this in perspective:

- $83.5 billion is more than the entire federal education budget ($79.6 billion in FY2024)

- It’s 6 times NASA’s budget ($13.3 billion)

- It’s nearly double the EPA’s budget ($43 billion)

- It could fund universal preschool ($15 billion estimated cost)

- It could eliminate student lunch debt ($262 million) 318 times over

And this exemption comes with minimal accountability. Churches don’t have to file most of the financial disclosures required of other nonprofits. They don’t have to prove they’re actually charitable. They don’t have to report how they spend money. They don’t even have to apply for tax-exempt status—it’s automatic.

The Rationale

The justification for religious tax exemption goes back to the separation of church and state. The reasoning: government shouldn’t tax religion because taxation implies control, and government control over religion violates the First Amendment.

In theory, churches are exempt because they provide public benefit: spiritual guidance, community support, charity work, moral education.

In practice, this means Joel Osteen’s $10.5 million mansion is subsidized by taxpayers. Kenneth Copeland’s private jets are subsidized by taxpayers. Every megachurch’s real estate empire pays zero property tax while schools and hospitals struggle to fund basic services.

The Abuse

Tax exemption was designed to protect small community churches providing genuine charitable services. But it’s been exploited by mega-businesses masquerading as ministries.

Examples of abuse:

- Churches owning luxury real estate and paying no property tax while neighboring homeowners pay thousands annually

- Pastors living in multimillion-dollar “parsonages” provided by the church, tax-free

- Church-owned businesses (bookstores, coffee shops, etc.) competing with taxed businesses

- Political activity disguised as religious expression (endorsing candidates, coordinating voter turnout)

- Private schools with million-dollar football stadiums paying no property tax

- The Catholic Church receiving $1.4 billion in PPP loans (yes, during COVID) while sitting on estimated assets exceeding $100 billion

The Catholic Church is worth a special mention. Estimates of the Church’s wealth vary, but U.S. Catholic Church holdings are conservatively estimated at $100-200 billion. This includes:

- Schools, universities, hospitals

- Real estate (churches, convents, administrative buildings)

- Investment portfolios

- Art and artifacts worth billions

Despite this wealth, the Catholic Church in the U.S. received $1.4 billion in PPP loans—money meant for struggling small businesses. And it was all forgiven. Taxpayer-funded.

Meanwhile, the Church has paid out over $4 billion in settlements for sex abuse cases. But they never ran out of money because the assets are protected and tax-exempt.

Buying Political Power: When Churches Become PACs

The Johnson Amendment, enacted in 1954, prohibits tax-exempt organizations from directly endorsing political candidates. Churches technically can’t say “Vote for [candidate]” without risking their tax-exempt status.

In practice, this restriction is widely ignored and rarely enforced.

How Churches Exercise Political Power

1. “Voter Education”:

Churches distribute “voter guides” that compare candidates on issues important to the church. These guides are technically non-partisan but always make one candidate look clearly preferable. Example: a guide might list a candidate’s position as “supports traditional marriage” versus “supports redefining marriage”—clearly biased framing.

2. Issue Advocacy:

Pastors can preach about political issues (abortion, LGBTQ rights, immigration) without technically endorsing candidates. But when only one party aligns with the church’s positions on these issues, the effect is the same as an endorsement.

3. Voter Mobilization:

Churches organize voter registration drives, provide transportation to polls, and coordinate “Souls to the Polls” events. These are technically non-partisan but overwhelmingly benefit one party.

4. Direct Endorsements (Increasingly Common):

Some pastors openly endorse candidates from the pulpit, daring the IRS to challenge their tax-exempt status. The IRS almost never does. Since 2008, over 2,000 pastors have signed pledges to endorse candidates as part of “Pulpit Freedom Sunday,” intentionally violating the Johnson Amendment. Zero churches have lost tax-exempt status.

5. Funding Dark Money Groups:

Churches can donate to 501(c)(4) “social welfare” organizations that engage in political activity without disclosing donors. This allows churches to fund political campaigns while maintaining tax exemption and secrecy.

The Impact

White evangelical Christians represent about 14% of the U.S. population but have outsized political influence because they vote as a bloc.

In 2020, 84% of white evangelicals voted for Trump. This consistency gives them enormous leverage: any Republican who loses evangelical support loses a crucial voting bloc.

This is why Republican politicians:

- Speak at megachurches and Christian conferences

- Promise to appoint judges who will overturn Roe v. Wade (accomplished)

- Oppose LGBTQ rights legislation

- Support “religious freedom” laws allowing discrimination

- Fight to maintain tax exemption for churches

- Promote school vouchers that fund religious schools

And in return, evangelical churches deliver votes. It’s a transactional relationship disguised as spiritual conviction.

But here’s the crucial point: while churches mobilize voters around cultural issues (abortion, LGBTQ rights, “traditional values”), the politicians they elect vote for economic policies that hurt the working-class people sitting in those pews.

Tax cuts for the wealthy? Check. Opposition to minimum wage increases? Check. Weakening labor protections? Check. Cutting Medicaid and food assistance? Check. Opposing universal healthcare? Check.

Churches deliver votes on cultural issues. Politicians deliver policies that benefit the wealthy. And the working-class Christians who make this possible keep getting economically screwed.

The Perfect Con

Let’s review what we’ve established:

- Religion provides unquestionable authority (“God said so”)

- Prosperity gospel justifies wealth inequality (rich people have more faith)

- Tax exemption subsidizes religious businesses ($83.5B annually)

- Political power delivers votes to politicians who serve the wealthy

- Working-class believers pay for it all while receiving nothing

This is wealth extraction at its finest. Better than healthcare, better than education, better than housing—because unlike those systems where exploitation is visible, religious exploitation is sacred. You can’t question it without challenging someone’s deepest beliefs.

Kenneth Copeland can own five private jets and nobody audits his ministry finances. Joel Osteen can live in a $10.5 million mansion while preaching prosperity to people in poverty. Creflo Dollar can literally ask for $65 million for a jet and people send money.

Try that in any other context:

- A CEO asking employees to fund his private jet? Outrage.

- A nonprofit director living in luxury while donors struggle? Investigation.

- A politician directly asking constituents for mansion money? Career-ending scandal.

But wrap it in religion and suddenly it’s acceptable. It’s blessed. It’s God’s will.

The genius is that the system is self-reinforcing:

- Give money → stay poor → told you need more faith → give more money

- Question the pastor’s wealth → you’re questioning God → you’re the problem

- Vote for politicians who hurt you economically → blame secular culture, not policies

- Economy gets worse → told it’s moral decline, not wealth extraction

It’s the perfect con because the victims defend it. They’re not being exploited—they’re exercising faith. They’re not being manipulated—they’re following God’s will. They’re not funding someone else’s luxury—they’re sowing seeds for their own blessing.

And anyone who points out the con? They’re attacking religion itself. They’re persecuting Christians. They’re doing Satan’s work.

This is why we covered religion’s role as a control mechanism in Part 15 before discussing the wealth extraction in this post. You need to understand that religion has always been used to maintain unjust power structures before you can see how American Christianity has been weaponized for profit.

Because once you see it, you can’t unsee it. The megachurch with the light show and the motivational speaking isn’t a church—it’s a theater. The prosperity gospel preacher with the private jet isn’t a minister—he’s a con artist. The tax exemption isn’t protecting religious freedom—it’s subsidizing wealth extraction.

And the $83.5 billion in annual tax exemptions? That’s not respecting religion. That’s funding it. Every American taxpayer—Christian, Muslim, Jewish, Hindu, Buddhist, atheist, agnostic—is forced to subsidize an industry that enriches pastors, funds political campaigns, and maintains systems of inequality.

Jesus said “my kingdom is not of this world.” American megachurch Christianity says “my kingdom has a 16,800-seat arena, multiple income streams, and zero tax liability.”

Guess which one is actually being followed.

—

This is Part 16 of “How Systems Are Rigged Against the Bottom 90%.” Following Part 15’s exploration of religion as a control mechanism, this post examines how American Christianity has become a wealth extraction machine. The pattern is consistent across every system we’ve examined: create unquestionable authority, exploit the vulnerable, accumulate wealth at the top, use political power to maintain the system, and keep the bottom 90% too divided or indoctrinated to fight back.

Leave a comment