Part 9 of the series: How Systems Are Rigged Against the Bottom 90%

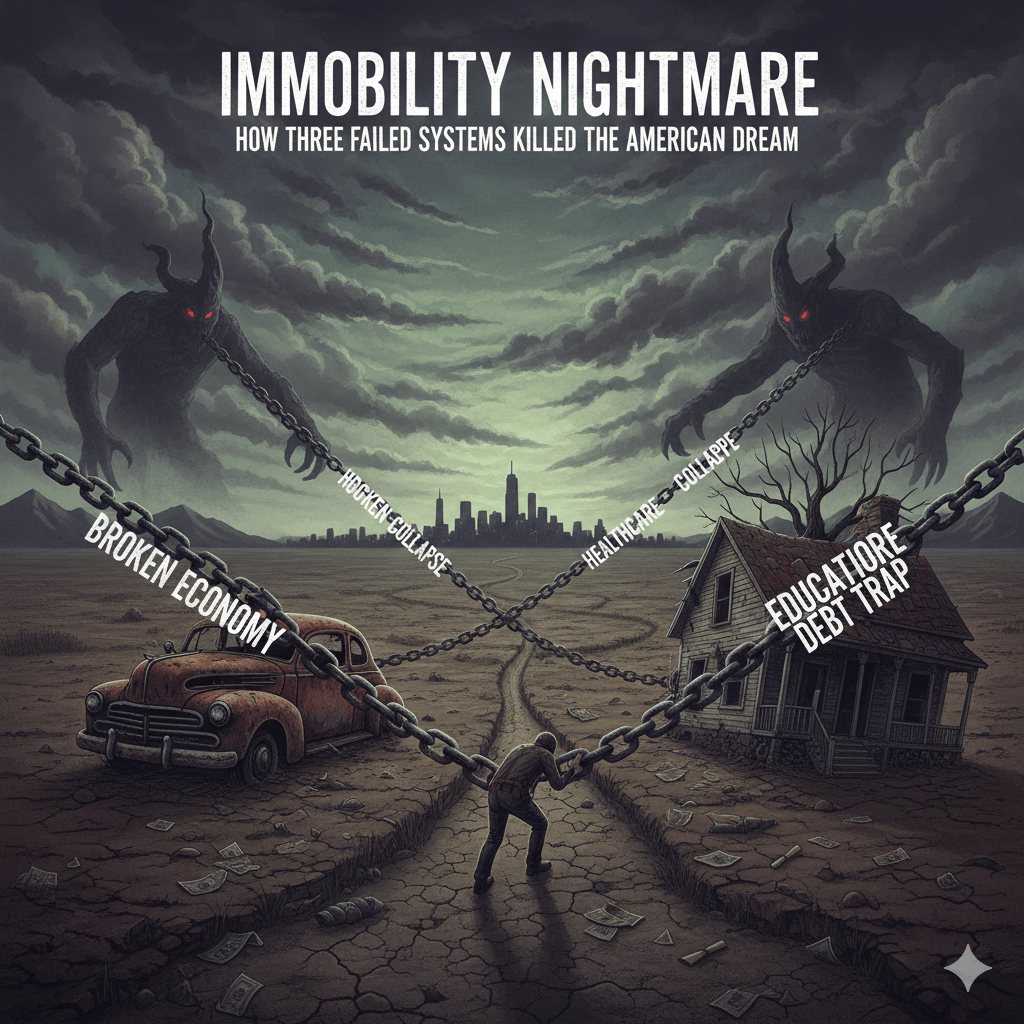

Here’s something we haven’t talked about yet: why these systems work so perfectly together.

We’ve covered healthcare. We’ve covered housing. We’ve covered education and childcare. And each one, individually, is extractive enough to keep most of us trapped. But here’s what makes the whole thing brilliant from the perspective of the people profiting: they’re not separate traps. They’re one integrated system, each reinforcing the others.

Can’t start a business? Well, you need employer-based healthcare, you’re trapped in a high-rent market because of single-family zoning, and you’re still paying off student loans. Can’t move for a better job? Same problem—your healthcare is tied to your current employer, moving means different housing costs you can’t afford, and your debt payments don’t pause. Can’t take a career risk? You’ve got childcare costs eating 35% of your income, student debt eating another chunk, and losing your job means losing your health insurance.

Each system creates dependence. Together, they create total immobility. And that immobility—that’s the point. Because immobile workers are controllable workers. Workers who can’t leave. Workers who can’t take risks. Workers who accept whatever they’re offered because the alternative is catastrophic.

Let’s look at exactly how this works.

The Basic Scenario: Why You Can’t Start That Business

You’re 32. You’ve been working for five years. You have an idea for a business—maybe it’s a good one, maybe it’s just okay, but you want to try. Here’s what you’re facing:

The Healthcare Trap

Your employer covers most of your health insurance. You pay maybe $200/month for a plan that would cost $600-800/month if you bought it yourself through the ACA marketplace. And that marketplace plan? It has a $7,000 deductible and worse coverage.

So step one of starting your business: you immediately need to find an extra $600-800/month and accept that if anything goes wrong medically, you’re on the hook for seven grand before insurance even starts paying.

But wait. You have a spouse. They work too. Do they quit their job to help with your business? Then you need family coverage. That’s $1,500-2,000/month with a $14,000 family deductible. Or does your spouse keep their job just for the healthcare? Congratulations, your spouse is now locked into a job they might hate, and your business can never be a joint venture.

Oh, and you have a kid? That’s $13,128/year in childcare costs on average. If you’re in a city, it’s more like $20,000. Your spouse needs to keep working just to cover childcare, let alone healthcare.

This is how 25% of Americans report staying in jobs they hate specifically because of healthcare benefits. Not because the job pays well. Not because they believe in the work. Because leaving means catastrophic health expenses.

The Housing Trap

Now let’s talk about where you live. Because starting a business means uncertain income, and uncertain income means you need low fixed costs. But we’ve made that impossible.

You’re probably renting—first-time homebuyers are now 38-40 years old because homes cost 7.6 times the median income. And because 75% of residential land in most cities is zoned for single-family homes only, there’s an artificial scarcity of housing that keeps rents high. In 2024, the median rent for a two-bedroom apartment hit $1,400/month nationally. In cities where jobs actually are? Try $2,500-3,500/month.

So even before you start your business, you’re spending 30-40% of your income on housing. The conventional wisdom says this is fine—that’s the “standard” amount. But that standard was set when homes cost 3.5 times income and when single-income households could afford to buy. Now homes cost 7.6 times income and both partners need to work full-time just to cover rent.

Want to cut costs by moving somewhere cheaper? Great idea! Except: Your current job is in the city. Moving means quitting. Quitting means losing healthcare. And your business idea might work in a city with customers and infrastructure, but not in a rural area with neither. You’re locked in place.

The Student Debt Trap

Let’s add one more thing: you probably have student loans. The average borrower has $39,000 in debt. At a typical interest rate, that’s $400-500/month in payments. Payments that don’t pause just because you want to start a business. Payments that can’t be discharged in bankruptcy. Payments that will follow you until they’re paid off or you die.

So now you need to cover: $800/month for health insurance (if single), $1,400/month for rent (national median), $400/month for student loans. That’s $2,600/month in fixed costs before you’ve bought food, paid utilities, put gas in your car, or invested a single dollar in your business idea.

$31,200/year in fixed costs just to exist.

And this assumes you’re single with no kids. Add a spouse and child, and you’re looking at $2,000/month for family health insurance, $13,128/year for childcare, plus the rest. You need $60,000-70,000/year in income just to cover basic survival costs. Before investing in your business. Before saving for emergencies. Before retirement.

This is why you can’t start that business. Not because the idea is bad. Because the cost of trying is catastrophic.

Why This Isn’t An Accident

Here’s what’s important to understand: this didn’t happen by accident. Each of these systems was designed this way, and each one reinforces the others.

Employer-Based Healthcare: Keeping Workers Dependent

Employer-based healthcare started during World War II as a way to get around wage controls. Companies couldn’t offer higher wages, so they offered health insurance instead. After the war, it became permanent—not because it was a good system, but because insurance companies and employers liked the control it gave them over workers.

In every other developed country, healthcare is universal. Employers don’t provide it. The government does. This means workers can leave jobs, start businesses, take career risks, negotiate for higher wages. They have mobility. Power.

But in the U.S., healthcare is tied to employment specifically to prevent that mobility. Can’t leave your job? Can’t negotiate. Can’t strike. Can’t start a competing business. You’re trapped, and that’s valuable to your employer.

This is why even businesses that would save money with universal healthcare oppose it. Small businesses would save 70-80% on healthcare costs with single-payer. Large corporations would save 50-60%. But some large corporations oppose it anyway—because they value the control over workers more than the cost savings.

Single-Family Zoning: Artificial Scarcity By Design

Single-family zoning didn’t emerge organically. It was implemented in the 1920s and expanded massively after World War II, explicitly to segregate neighborhoods by race and class. The idea was simple: if you require large lots and single-family homes, you make it impossible for lower-income people to move in.

Today, 75% of residential land in most American cities is zoned for single-family homes only. No apartments. No duplexes. No townhouses. Just single-family homes on large lots. This creates artificial scarcity—there’s plenty of land, but it’s illegal to build housing that normal people can afford.

The result? Housing costs have exploded. In 1970, the median home cost 3.5 times the median household income. In 2024, it costs 7.6 times. Not because construction costs doubled. Not because land became scarce. Because we made it illegal to build affordable housing in the places where people need to live.

This benefits existing homeowners—who get to watch their home values rise and rise—and investment firms like Blackstone that can buy up entire neighborhoods and rent them back to families who can’t afford to buy. Everyone else gets trapped in place, spending 30-40% of their income on rent with no ability to move for better opportunities.

Student Debt: Designed to Follow You Forever

Student debt is the only form of debt that cannot be discharged in bankruptcy. This wasn’t always true. Until 1976, student loans could be discharged like any other debt. But then Congress changed the law, making student debt special—permanent, inescapable, following borrowers until death.

Why? Because student debt had become too profitable to let borrowers escape it. By 2024, there’s $1.8 trillion in outstanding student debt held by 42.5 million borrowers. This debt has been packaged into securities called SLABS (Student Loan Asset-Backed Securities) and sold to investors who depend on those monthly payments.

So student debt can’t be discharged because investors need those payments to continue. Forever. And because the debt is guaranteed by the government, there’s no risk to lenders—they get paid whether borrowers can afford it or not.

This creates a permanent financial burden that makes risk-taking impossible. Want to start a business? That $400/month in student loan payments doesn’t care. Want to take a lower-paying job doing something you love? The debt doesn’t pause. Want to go back to school to change careers? More debt.

Each system was designed to be inescapable. Together, they create total control.

The Scenarios: How It Actually Plays Out

Let’s look at real scenarios to see exactly how this trap works.

Scenario 1: Sarah Wants to Start a Business

Sarah is 34. She’s been working in marketing for eight years and has an idea for a consulting business. Here’s her situation:

Healthcare: Her employer covers 75% of her health insurance. She pays $150/month. If she leaves, she needs ACA marketplace coverage: $650/month with a $7,000 deductible. Cost to leave: +$500/month, +$7,000 risk.

Housing: She rents a one-bedroom apartment for $1,800/month in a city where clients actually are. She looked at cheaper areas, but they’re 45 minutes away and her current lease has six months left. Breaking the lease costs two months’ rent: $3,600. Cost to stay: $1,800/month. Cost to move: $3,600 up front, plus time and opportunity costs.

Student Debt: She has $43,000 in loans from her bachelor’s and master’s degrees. Payments: $425/month. These don’t pause. Cost: $425/month, non-negotiable.

Total Fixed Costs: $650 (insurance) + $1,800 (rent) + $425 (loans) = $2,875/month = $34,500/year.

Sarah’s current job pays $72,000/year. After taxes, she takes home about $54,000. After fixed costs ($34,500), she has $19,500 left for food, utilities, transportation, phone, internet, clothing, emergency savings, retirement. That’s $1,625/month.

Now she wants to start her business. To do it safely, she should have 6-12 months of expenses saved. At $2,875/month in fixed costs alone, that’s $17,250-34,500. She currently has $8,000 saved.

So to start her business, Sarah needs: (1) Another $9,000-26,500 in savings (2-6 years at current savings rate), (2) Confidence that her business will generate $2,875/month within 6-12 months, (3) Acceptance that one medical emergency could bankrupt her even with insurance.

Sarah stays at her job. Not because her business idea is bad. Because trying is too risky.

Scenario 2: Marcus Gets a Job Offer in Another City

Marcus is 29. He works in software development and just got a job offer in Austin that pays $15,000 more per year than his current job in Cleveland. Seems like an obvious choice, right?

Here’s what Marcus is looking at:

Healthcare: His current employer has good insurance with low deductibles. The new company’s insurance has higher deductibles and out-of-pocket maximums. He also has a chronic condition that requires quarterly specialist visits. Difference in annual costs: +$2,400/year in higher premiums and deductibles.

Housing: Marcus rents a two-bedroom apartment in Cleveland for $1,100/month. In Austin, comparable apartments are $2,200/month. Difference: +$13,200/year. Plus he’ll need first month, last month, security deposit, and moving costs: roughly $8,000 up front.

Student Debt: Marcus has $28,000 in loans, $280/month in payments. These payments don’t change whether he moves or not, but they make it harder to save for the move.

Let’s do the math. The new job pays $15,000 more per year. But higher housing costs $13,200 more and healthcare costs $2,400 more. Net gain: -$600/year. He’d be making less money after rent and healthcare.

Plus he needs $8,000 up front to move, and he currently has $5,000 saved. He’d have to borrow or drain his emergency fund completely.

Marcus turns down the job. Not because it’s a bad opportunity. Because the math doesn’t work when housing and healthcare costs eat the entire salary increase.

Scenario 3: Jennifer Wants to Change Careers

Jennifer is 36, married with a 4-year-old daughter. She works in finance but wants to become a teacher. Here’s her trap:

Healthcare: Jennifer’s employer provides family health insurance. Her husband’s employer doesn’t. If Jennifer quits to go back to school, the family needs coverage. Her husband’s employer offers it: $1,850/month with a $14,000 family deductible. Cost: $1,850/month or $22,200/year.

Childcare: They pay $1,400/month for full-time care while both parents work. If Jennifer goes back to school part-time while working, she still needs full-time childcare: $1,400/month. If she goes back full-time and doesn’t work, same cost: $1,400/month.

Housing: They own a home with a $2,200/month mortgage. They bought at the peak of the market in 2022. They can’t sell without losing money, and they can’t afford the mortgage on just her husband’s salary plus childcare costs.

Student Debt: Jennifer still has $31,000 in loans from her MBA. Payments: $320/month. And if she goes back to school for a teaching credential, she’ll need to borrow more. Teaching jobs in her area start at $45,000—$40,000 less than she makes now.

The Math: Jennifer currently makes $85,000. Her husband makes $62,000. Combined: $147,000. Their fixed costs: $2,200 (mortgage) + $1,400 (childcare) + $320 (loans) + $450 (family insurance premium) = $4,370/month = $52,440/year.

If Jennifer becomes a teacher, she’ll make $45,000. Combined household income drops to $107,000. After their fixed costs, they’ll have $54,560 left annually instead of $94,560. That’s $40,000 less per year—exactly what Jennifer would lose in salary.

But wait—what about the time Jennifer is in school? She’ll need to borrow at least $20,000 more in student loans for a credential program. And during that year, the family income drops to just her husband’s $62,000. After fixed costs, they have $9,560 left for the entire year. For food, utilities, transportation, emergency costs for a family of three.

Jennifer stays in finance. Not because she doesn’t want to teach. Because her family can’t afford the transition.

The System Working As Designed

Look at what these scenarios have in common:

Sarah can’t start her business—not because the idea is bad, but because she can’t afford to try. Marcus can’t take a better job—not because the opportunity isn’t real, but because housing costs eat the salary increase. Jennifer can’t change careers—not because she lacks the ability, but because the transition cost is catastrophic.

In every case, the person is trapped. Not by lack of skill. Not by lack of opportunity. By the interconnected systems of healthcare, housing, and education debt that make any change too expensive to consider.

This is the design. This is how it’s supposed to work.

Why Immobility Benefits the Top 10%

Worker immobility is profitable. Extremely profitable. When workers can’t leave, can’t negotiate, can’t take risks, employers have total leverage. Wages stay low. Benefits stay minimal. Working conditions can deteriorate because what are you going to do, quit and lose your health insurance?

This is why productivity has increased 61.6% since 1979 while wages have increased only 17.5%. Workers are generating more value than ever, but they have no leverage to demand a fair share of it because leaving is too risky.

It’s also why union membership has collapsed from 33% in 1955 to 10% today. Can’t strike when you’ll lose your healthcare. Can’t organize when losing your job means losing your ability to afford rent. Can’t demand better conditions when the cost of unemployment is medical bankruptcy.

The immobility serves multiple functions: 1. It suppresses wages by eliminating workers’ ability to negotiate. 2. It prevents competition by making entrepreneurship too risky. 3. It maintains geographic inequality by preventing people from moving to where opportunities are. 4. It extracts maximum value through rent (housing), debt payments (student loans), and insurance premiums (healthcare).

Every single one of these functions transfers wealth from the bottom 90% to the top 10%. And the beauty of it—from the perspective of the people profiting—is that it’s self-reinforcing. The more trapped you are, the less power you have to change anything.

The Breaking Points

Here’s the thing about traps: you don’t realize you’re in one until you try to leave. And for most people, the first time they realize how trapped they are is when something forces them to try to move.

Medical Emergency

You get sick. Really sick. Cancer, major injury, chronic illness requiring expensive treatment. Suddenly, your employer-based insurance—which seemed adequate—reveals itself as barely functional. High deductibles. Claim denials. Prior authorizations. And you can’t leave your job because losing your insurance mid-treatment is unthinkable.

Even with insurance, the average cancer patient spends $5,000 out-of-pocket per year. More than half of cancer patients report significant financial hardship. 42% deplete their life savings within two years of diagnosis.

And you’re stuck—can’t quit the job you hate, can’t start that business, can’t move for better care—because you need the insurance. Even bad insurance is better than none.

Job Loss

Layoffs happen. Your company downsizes. You’re suddenly unemployed and facing: no healthcare (COBRA costs $1,800/month), rent due ($1,400-2,500/month), student loans ($400/month), and no income. You have three months of savings if you’re lucky. Six weeks if you’re average. Nothing if you’re living paycheck to paycheck like 64% of Americans.

You need a new job immediately. Not a good job. Not the right job. Any job with health insurance. Because without insurance, one medical emergency ends you financially. So you take the first offer, even if it pays less, even if it’s in the wrong field, even if it’s terrible—because you need the healthcare.

This is how people end up in worse and worse positions over time. Each job loss forces a compromise. Each compromise reduces your leverage for the next negotiation. The trap gets tighter.

Having a Child

You have a baby. Congratulations! Now you need: (1) Better health insurance because infants and small children get sick constantly and pediatric care is expensive, (2) Childcare at $13,128/year average or $20,000+ in cities, (3) More space, which means higher rent or a bigger mortgage, (4) More income to cover all of this while one or both parents lose work time for parental leave (if you even get it) and childcare logistics.

The middle-class squeeze intensifies. Both parents need to work full-time just to cover childcare. Can’t reduce hours because you need the income and the insurance. Can’t take career risks because the family needs stability. Can’t move because childcare arrangements and school systems and family support networks are all localized.

You’re more trapped than ever. And it lasts for 18 years minimum.

Why Breaking Free From One Trap Doesn’t Help

Here’s the genius of the interconnected system: you can’t escape by solving just one problem.

What If You Pay Off Your Student Loans?

Great! You’ve eliminated $400/month in fixed costs. But you still need employer-based healthcare ($600-800/month if you leave your job), and you still need housing ($1,400-2,500/month), and you still need childcare if you have kids ($1,100/month). Paying off your loans gave you a bit more breathing room, but you’re still trapped by the other systems.

What If You Move to a Cheaper City?

You found a city where rent is $900/month instead of $2,200/month. Fantastic! But: (1) Are there jobs in your field there? Because you need employer-based healthcare, so you need a job with benefits. (2) Are there jobs that pay enough to cover your student loans and living expenses? (3) Do you have family or social support there to help with childcare? Moving to save on rent but losing childcare support means you’re paying more overall.

Plus, moving costs money up front—first month, last month, security deposit, moving truck, time off work. If you’re living paycheck to paycheck, you can’t afford to move even to somewhere cheaper.

What If You Get Better Health Insurance?

You find a job with better insurance. Lower premiums, lower deductibles. Great! But that job might pay less, or be in a more expensive city, or require you to move and reset your housing situation. And you still have student loans and childcare costs. Better insurance reduces one source of anxiety but doesn’t fundamentally change your ability to take risks or make changes.

The traps are interconnected. Solving one doesn’t free you because you’re still caught in the others. This is intentional. If the systems were independent, you could escape them one at a time. But they’re designed to work together, each reinforcing the others, creating total immobility.

The International Comparison: Proving the U.S. Is the Outlier

As always, we need to check: is this just how modern economies work? Or is the U.S. uniquely extractive?

Spoiler: it’s uniquely extractive.

Healthcare Mobility

In every other developed country, healthcare is universal and not tied to employment. This means:

• Germany: Healthcare is provided by the government through statutory health insurance. If you quit your job to start a business, your healthcare continues. Cost to self-employed: ~14.6% of income with caps, no deductibles, comprehensive coverage.

• Canada: Healthcare is fully public and free at point of service. Quitting your job doesn’t affect your coverage at all. No premiums. No deductibles. No bankruptcies from medical debt.

• UK: National Health Service provides free healthcare to all residents. Starting a business? Healthcare is covered. Changing careers? Healthcare is covered. Unemployed? Healthcare is covered.

The result? People in these countries have actual mobility. They can start businesses without risking medical bankruptcy. They can change careers without losing coverage. They can negotiate with employers from a position of strength because healthcare isn’t on the table.

This translates to higher rates of entrepreneurship. Germany has 14% self-employment rate. UK has 15%. Canada has 15%. U.S.? 10%. Our entrepreneurship rate is lower specifically because healthcare makes it too risky to leave traditional employment.

Housing Costs

Housing costs relative to income:

• Germany: Median home costs 4.9x median income. Most cities allow medium-density housing. Renting is normalized—51% of Germans rent long-term. Strong tenant protections.

• Japan: Median home costs 3.8x median income. Tokyo allows mixed-use, medium-density development everywhere. Result: Housing stays affordable even in the largest city.

• Netherlands: Median home costs 5.2x median income. But: Strong social housing programs (30% of housing), rent controls, and mixed-density zoning keep costs manageable.

• U.S.: Median home costs 7.6x median income. 75% of residential land zoned single-family only. Renting is stigmatized as “throwing money away.” Weak tenant protections. Result: Housing eats 30-40% of income for most people.

Other countries treat housing as a basic need and regulate accordingly. The U.S. treats it as an investment vehicle and wonders why normal people can’t afford homes.

Education Costs

• Germany: Public universities are tuition-free. Students pay ~€300/semester in administrative fees. Average student graduates with €3,000 in debt (if any). Loans are interest-free and capped at €10,000.

• Norway: Public universities are tuition-free for all students including international. Living costs are supported by grants and low-interest loans. Average debt at graduation: $30,000, but with strong social safety nets and high wages, it’s manageable.

• Australia: Public universities charge fees, but they’re capped at ~$7,000/year AUD (~$4,600 USD). Students don’t pay up front—costs are covered by income-contingent loans that are only repaid when income exceeds a threshold. No interest, just inflation adjustment.

• U.S.: Public universities charge $10,000-30,000/year for in-state tuition. Private universities charge $40,000-80,000/year. Average student graduates with $39,000 in debt at 5-7% interest rates. Debt cannot be discharged in bankruptcy. 42.5 million Americans carry student debt totaling $1.8 trillion.

Other countries treat education as a public good that benefits society. The U.S. treats it as a private investment that individuals must fund themselves—and then wonders why people are trapped by debt.

Childcare Costs

• Sweden: Universal childcare with fees capped at 3% of household income (max ~$130/month). Result: 80% of mothers work, child poverty is 9%.

• France: Universal childcare starting at age 2-3 (earlier for lower-income families). Costs are subsidized based on income. Average cost: $600-800/year. Not a typo. Per year.

• Germany: Childcare is heavily subsidized with fees capped based on income. Average cost: $200-400/month. Berlin made childcare free in 2018.

• U.S.: Average childcare cost is $13,128/year—more than in-state public college tuition. In 45 states, childcare costs more than housing. No universal program. No subsidies for most families. Result: Many parents—especially mothers—drop out of the workforce because childcare costs more than they’d earn.

Other countries recognize that childcare is essential infrastructure for a functioning economy. The U.S. treats it as a private problem individuals must solve, then wonders why labor force participation among parents is so low.

The Combined Effect: Total Immobility

Let’s compare total system burden between the U.S. and other developed countries:

Scenario: 32-Year-Old Professional Wants to Start a Business

Germany:

• Healthcare: Continues through statutory insurance, ~€400/month (~$440) with no deductibles • Housing: Rent for 2-bedroom: €800-1,200/month (~$880-1,320) • Student debt: €0 (graduated debt-free) • Total monthly burden: ~$1,320-1,760

Annual fixed costs to start business: $15,840-21,120. And this includes comprehensive healthcare with no deductibles, no prior authorizations, no claim denials.

United States:

• Healthcare: ACA marketplace plan $650/month with $7,000 deductible • Housing: Rent for 2-bedroom: $1,400/month (national median) • Student debt: $400/month • Total monthly burden: $2,450

Annual fixed costs to start business: $29,400. Plus you’re on the hook for the first $7,000 in medical expenses before insurance even starts paying. And your insurance is worse—higher copays, more claim denials, narrower networks.

Scenario: Family with Young Child, Both Parents Working

Sweden:

• Healthcare: Free • Housing: Rent for 3-bedroom: $1,200/month • Childcare: $130/month (3% of income cap) • Student debt: Minimal to none • Total monthly burden: $1,330

Annual cost: $15,960. Both parents can work because childcare is affordable. Either parent could take a career risk without catastrophic consequences.

United States:

• Healthcare: Family coverage $1,850/month with $14,000 deductible • Housing: Rent for 3-bedroom: $2,100/month • Childcare: $1,100/month • Student debt: $600/month (both parents) • Total monthly burden: $5,650

Annual cost: $67,800. This is before food, utilities, transportation, clothing, or any savings. If one parent makes less than $40,000/year after taxes, they’re working just to pay for childcare and their healthcare premium. And if either parent loses their job, the family loses healthcare.

The difference isn’t subtle. It’s catastrophic. In Sweden, this family has mobility, options, breathing room. In the U.S., they’re trapped, living paycheck to paycheck despite both parents working full-time, with no ability to take any risks or make any changes.

Who Benefits From the Perfect Trap

Let’s be specific about who profits from keeping Americans trapped:

Health Insurance Companies

Employer-based insurance is incredibly profitable because it eliminates competition. Workers can’t shop around—they get what their employer offers. And employers negotiate rates based on keeping costs down, not maximizing quality. The insurance companies extract profit at every point.

• UnitedHealth Group: $324.2B in revenue (2023), CEO Andrew Witty compensated $23.5M • Cigna: $195.3B in revenue (2023), CEO David Cordani compensated $20.9M • Anthem/Elevance: $171.3B in revenue (2023), CEO Gail Boudreaux compensated $21.3M

These companies don’t want universal healthcare because it would eliminate their business model. They lobby Congress heavily—$1.2 billion in lobbying between 2009-2020 from healthcare industries—specifically to keep employer-based insurance in place.

Large Employers

Corporations benefit from employer-based healthcare even though it costs them money because it gives them leverage over workers. Can’t leave? Can’t negotiate. Can’t strike. Healthcare dependence keeps workers compliant.

This is why even corporations that would save money with universal healthcare often oppose it. The control is worth more than the cost savings.

Real Estate Investment Firms

Blackstone, Invitation Homes, and other investment firms profit enormously from high housing costs and artificial scarcity. Single-family zoning creates the scarcity. They exploit it by buying up housing and renting it back to families who can’t afford to buy.

• Blackstone: $1 trillion in assets under management, bought 40,000+ single-family homes after 2008 crash • Invitation Homes: 80,000+ single-family rental properties across the U.S. • American Homes 4 Rent: 59,000+ single-family rental properties

These firms lobby local governments to maintain single-family zoning and oppose affordable housing developments. They profit from artificial scarcity.

Existing Homeowners

The top 10% of households own 40% of all real estate. They benefit from rising home prices—their wealth increases even though they’re not producing anything. This is why affluent homeowners fight against new housing development: they profit from scarcity.

NIMBYism (Not In My Back Yard) is explicitly about protecting property values by preventing new construction. It’s dressed up as concern about “neighborhood character” or “traffic,” but it’s really about keeping home prices high by preventing supply from meeting demand.

Student Loan Servicers and SLABS Investors

Student debt has been packaged into securities (SLABS) and sold to investors who depend on those monthly payments. The industry profits from keeping borrowers in debt as long as possible.

• Navient (loan servicer): Settled for $1.85B in 2022 over predatory lending practices • Nelnet (loan servicer): $356M in revenue from loan servicing (2023) • SoFi (refinancing company): $2.05B in revenue (2023), profits from refinancing student loans at high rates

These companies lobby against student debt forgiveness and against allowing student loans to be discharged in bankruptcy. They need borrowers trapped in debt indefinitely.

For-Profit Colleges

For-profit colleges extract billions from students who can’t afford traditional universities. These schools get 98% of their revenue from federal student loans and have 52% default rates. They exist purely to extract federal loan money from low-income students.

• Grand Canyon Education: $1.1B in revenue (2023) • Chegg: $756M in revenue (2023) • Strategic Education: $1.1B in revenue (2023)

These institutions have gotten rich by trapping low-income students in debt for degrees that often don’t lead to employment.

Solutions: Why They Must Be Simultaneous

Here’s the critical insight: because these systems are interconnected, solutions must address all of them simultaneously. Fixing one while leaving the others intact doesn’t create mobility—it just shifts where people are trapped.

Universal Healthcare

What it solves: Healthcare dependence on employers. Medical bankruptcy. The impossibility of starting businesses or changing careers without risking catastrophic health expenses.

What it costs: Approximately $3.2-3.5 trillion/year for single-payer universal coverage (current healthcare spending is $4.3 trillion). Net savings: $800 billion to $1.1 trillion annually.

How it’s paid: Progressive income tax and payroll tax replacing insurance premiums and out-of-pocket costs. Most families save money—the median household currently spends $8,200/year on healthcare premiums alone, plus deductibles and copays.

International examples: Canada, UK, Taiwan, Australia all spend less per capita than the U.S. and achieve better health outcomes.

Eliminate Single-Family Zoning

What it solves: Artificial housing scarcity. High rents and home prices. Geographic immobility. Inability to move for better opportunities.

What it costs: Nothing. This is a regulatory change. Cities simply allow medium-density development (duplexes, townhouses, small apartment buildings) in areas currently zoned for single-family only.

Expected impact: Studies suggest housing costs could decrease 20-40% in major cities within 5-10 years as supply catches up to demand.

International examples: Japan allows mixed-use, medium-density development everywhere. Tokyo remains affordable despite being the world’s largest city. Germany allows similar flexibility. Result: Housing costs 4-5x median income instead of 7.6x.

Ban or Heavily Tax Corporate Ownership of Single-Family Homes

What it solves: Investment firms artificially inflating housing prices by buying properties as investment vehicles. Local families being outbid by firms with infinite capital.

What it costs: Nothing if implemented as a ban. If implemented as a tax, could generate revenue while disincentivizing corporate ownership.

Mechanism: Require single-family homes to be sold to owner-occupants or tax corporate ownership at rates that make it unprofitable. Force divestment over 5-10 years.

International examples: Denmark bans corporate ownership of certain types of housing. Singapore heavily taxes foreign and corporate ownership. Switzerland restricts foreign real estate ownership.

Free Public Universities and Trade Schools

What it solves: Student debt trap. Inability to change careers. Financial burden that makes entrepreneurship impossible.

What it costs: Approximately $70 billion/year to make all public colleges and universities tuition-free.

How it’s paid: Tiny financial transaction tax (0.1% on stock trades, 0.01% on bond trades) would raise $75 billion/year. This is smaller than the tax European countries already have.

International examples: Germany, Norway, Finland, Denmark, Sweden all have tuition-free public universities. Result: Students graduate with minimal to no debt, can take career risks, can start businesses.

Student Debt Forgiveness + Allow Bankruptcy Discharge

What it solves: Existing debt trap for 42.5 million Americans. Inability to take financial risks. Permanent financial burden.

What it costs: $1.8 trillion in total outstanding debt. Could be implemented gradually or with income caps (forgive debt for those making under $125K/year).

How it’s justified: This debt was created through predatory lending, inflated tuition costs, and a system that trapped young people before they understood the consequences. The government already forgives debt regularly—see PPP loan forgiveness ($800 billion, much of it fraudulent), bank bailouts ($700 billion in 2008), agricultural subsidies.

Additional reform: Allow student debt to be discharged in bankruptcy like any other debt. Remove the special protection that makes it inescapable.

Universal Childcare

What it solves: Families trapped because childcare costs more than one parent earns. Women dropping out of workforce. Parents unable to take career risks.

What it costs: Approximately $150 billion/year for universal public childcare.

Economic benefit: Studies show universal childcare returns $8.60 for every dollar spent through increased labor force participation (especially women), higher tax revenue, better child development outcomes, and increased consumer spending.

International examples: Sweden caps childcare at 3% of household income ($130/month max). France provides universal childcare at $600-800/year. Germany provides subsidized childcare at $200-400/month. All have higher labor force participation than the U.S.

Why This Package Matters

These solutions must be implemented together because they address interconnected traps:

Universal healthcare + Ending single-family zoning = You can start a business without risking medical bankruptcy AND you can afford housing without dedicating 40% of your income to rent.

Universal healthcare + Free public universities + Debt forgiveness = You can change careers without losing health coverage AND without being trapped by existing debt AND without taking on more debt for retraining.

Affordable housing + No student debt + Universal childcare = Families can afford to have children, move for opportunities, take career risks, and save for the future.

Together, these changes restore mobility. Workers can negotiate from strength because losing a job isn’t catastrophic. Entrepreneurs can start businesses without risking everything. Families can afford children without both parents trapped in jobs they hate. People can move for opportunities because housing is affordable and healthcare travels with them.

This is what every other developed country has. Not because they’re socialist. Not because they’re less innovative. Because they recognize that economic mobility benefits everyone—except the people who profit from keeping workers trapped.

Who Opposes This and Why

If these solutions work everywhere else, save money, and benefit the bottom 90%, why haven’t we implemented them?

Because the top 10% profits enormously from the current system, and they’ve spent billions ensuring it doesn’t change.

The Lobbying Numbers

• Healthcare industry: $1.2 billion in lobbying (2009-2020) to prevent universal healthcare • Real estate industry: $500+ million annually in lobbying to maintain favorable zoning and tax policies • For-profit colleges: $150+ million annually in lobbying to prevent regulation and maintain access to federal student loans • Private equity firms: $200+ million annually across all sectors they control (healthcare, housing, education)

This is why we have employer-based healthcare instead of universal coverage. Why we have single-family zoning instead of mixed-density development. Why we have inescapable student debt instead of free public universities. Why we have no childcare support instead of universal programs.

The systems are maintained through lobbying, campaign contributions, and regulatory capture. Both parties take money from these industries. Both parties perpetuate these systems.

The Ideological Cover

These extractive systems are defended with language we’ve already identified as manipulative:

• “Free market solutions” = Let insurance companies and investment firms extract maximum profit while people die and go homeless • “Personal responsibility” = If you can’t afford healthcare, housing, and education while trapped by all three, it’s your fault • “Socialism” = Any policy that helps the bottom 90% instead of the top 10% • “Government overreach” = Any regulation that prevents extraction and abuse • “Incentivizing laziness” = Any support that gives workers leverage to negotiate better conditions

These aren’t principled positions. They’re marketing language designed to defend extraction. And they work because they prevent honest analysis of what these systems actually do.

Conclusion: Breaking the Trap Requires Breaking All Three Locks

The perfect trap isn’t any single system. It’s how they work together.

Healthcare ties you to your employer. Housing costs trap you in place. Student debt makes risk impossible. Childcare costs force both parents to work regardless of what’s best for the family. Together, they create total immobility.

And immobility is the point. Workers who can’t leave have no leverage. Workers who can’t take risks can’t threaten existing power structures. Workers who spend 60-70% of their income on survival costs can’t accumulate wealth. Workers who are trapped are controllable.

Every other developed country has solved these problems. They have universal healthcare, affordable housing, free or low-cost education, and comprehensive childcare support. Their workers have mobility. Power. Options. And those countries are thriving—better health outcomes, higher life expectancy, lower child poverty, stronger social mobility.

The U.S. doesn’t have these things because a small group of people profit enormously from keeping the majority trapped. Insurance companies, real estate investment firms, loan servicers, large employers who value worker control over cost savings—they’ve spent billions lobbying to maintain these systems. Both parties take their money. Both parties perpetuate the trap.

The solutions exist. They work everywhere else. They would save money. They would benefit 90% of Americans. They would restore economic mobility and opportunity.

But implementing them requires recognizing that these systems aren’t separate problems. They’re one integrated trap. You can’t fix healthcare without fixing housing. You can’t fix housing without fixing education debt. You can’t fix education without fixing childcare. They must be addressed simultaneously because that’s how they function—as one unified system of control and extraction.

Breaking free means demanding all of it: Universal healthcare. End single-family zoning. Free public universities. Forgive student debt. Universal childcare.

Not because we’re asking for handouts. Because these policies work everywhere else, cost less than what we’re currently paying, and benefit everyone except the people who profit from keeping us trapped.

The question isn’t whether we can afford it. The question is why we’re still tolerating a system designed to extract maximum wealth from the bottom 90% while ensuring we can never escape.

The trap is perfect. But it’s not inevitable. And that’s what makes the choice to maintain it inexcusable.

Next time: We’ll examine one more trap in depth—the prison industrial complex. How mass incarceration extracts wealth while providing free labor, why the U.S. has 4% of the world’s population but 25% of its prisoners, and who profits from keeping 2.3 million Americans locked up.

Leave a comment